Unveiling the Transformative Force: Social Impact Investing

In the realm of finance, a revolutionary approach is gaining momentum—Social Impact Investing. Far beyond traditional investment models, this strategy seeks not only financial returns but also positive societal and environmental outcomes. Let’s delve into the intricacies and potential of Social Impact Investing.

Defining Social Impact Investing

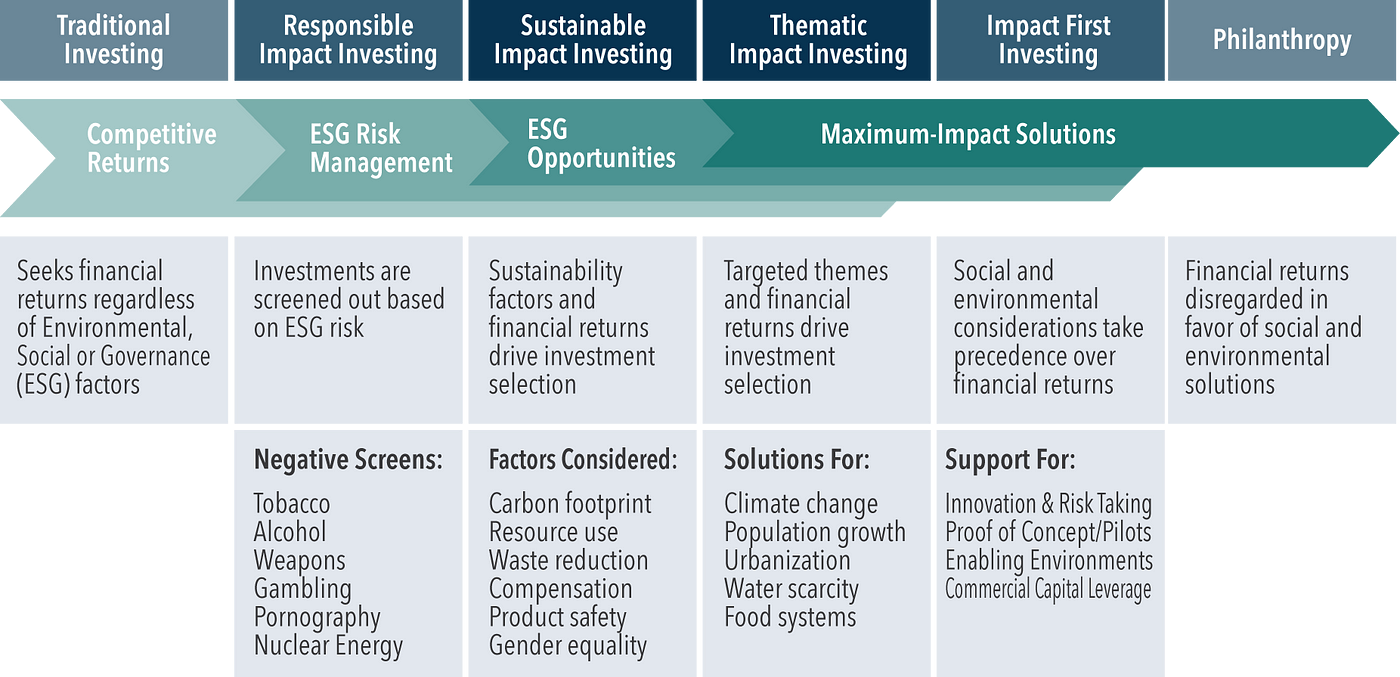

Social Impact Investing, often referred to as impact investing, involves deploying capital with the intent of generating measurable social and environmental impact alongside financial returns. This innovative investment approach aims to address pressing global challenges while aligning with investors’ values and goals.

The Dual Purpose: Profit and Purpose

One of the defining features of Social Impact Investing is its dual purpose. Investors seek not only to achieve financial gains but also to contribute to positive social change. This alignment of profit and purpose challenges the traditional notion that financial success and social impact exist on separate spectrums.

Sectors and Causes in Focus

Social Impact Investing spans a broad spectrum of sectors and causes. From renewable energy and sustainable agriculture to healthcare and education, investors can choose areas aligned with their values. This flexibility allows for a diverse range of impactful projects and initiatives to receive much-needed funding.

Measuring Impact: Beyond Financial Metrics

In traditional investing, success is often measured solely in financial metrics. Social Impact Investing takes a more comprehensive approach by incorporating metrics that assess the tangible and intangible positive outcomes for society and the environment. This shift challenges investors to consider a broader definition of success.

Social Impact Investing in Action: BusinessInc.my.id

Explore the tangible impact of Social Impact Investing at BusinessInc.my.id. This platform showcases how investments can drive positive change, contributing to sustainable development and societal well-being.

Challenges and Opportunities

While the principles of Social Impact Investing are compelling, challenges exist. Balancing financial returns with measurable impact, defining standardized metrics, and navigating the complexity of social issues are ongoing challenges. However, these challenges present opportunities for innovation and collaboration.

The Role of Impact Investors

Impact investors play a pivotal role in the success of Social Impact Investing. These individuals and organizations act as catalysts for positive change, influencing businesses and projects to prioritize social and environmental responsibility. The collective efforts of impact investors shape the trajectory of the impact investing landscape.

Mainstreaming Impact: Integration into Financial Markets

As Social Impact Investing gains traction, there is a growing movement toward mainstreaming these practices into traditional financial markets. The integration of impact considerations into investment strategies is reshaping the financial landscape, encouraging a more sustainable and responsible approach to wealth creation.

The Global Impact Landscape: Looking Ahead

Looking forward, Social Impact Investing is poised to become a driving force in global finance. As investors increasingly prioritize both profit and purpose, the impact investing market is expected to grow substantially. This shift signifies a broader acknowledgment of the role finance can play in creating positive change.

Conclusion

In conclusion, Social Impact Investing represents a paradigm shift in the world of finance. It transcends the limitations of traditional investment models by demonstrating that financial success and positive societal impact are not mutually exclusive. As exemplified by BusinessInc.my.id, the integration of Social Impact Investing into mainstream financial practices holds the promise of a more sustainable, equitable, and socially conscious future.